Can Bitcoin's Hashrate Predict Its Next Price Move?

You can use the Bitcoin hashrate v price chart to gauge miner sentiment and anticipate price movements based on network security trends.

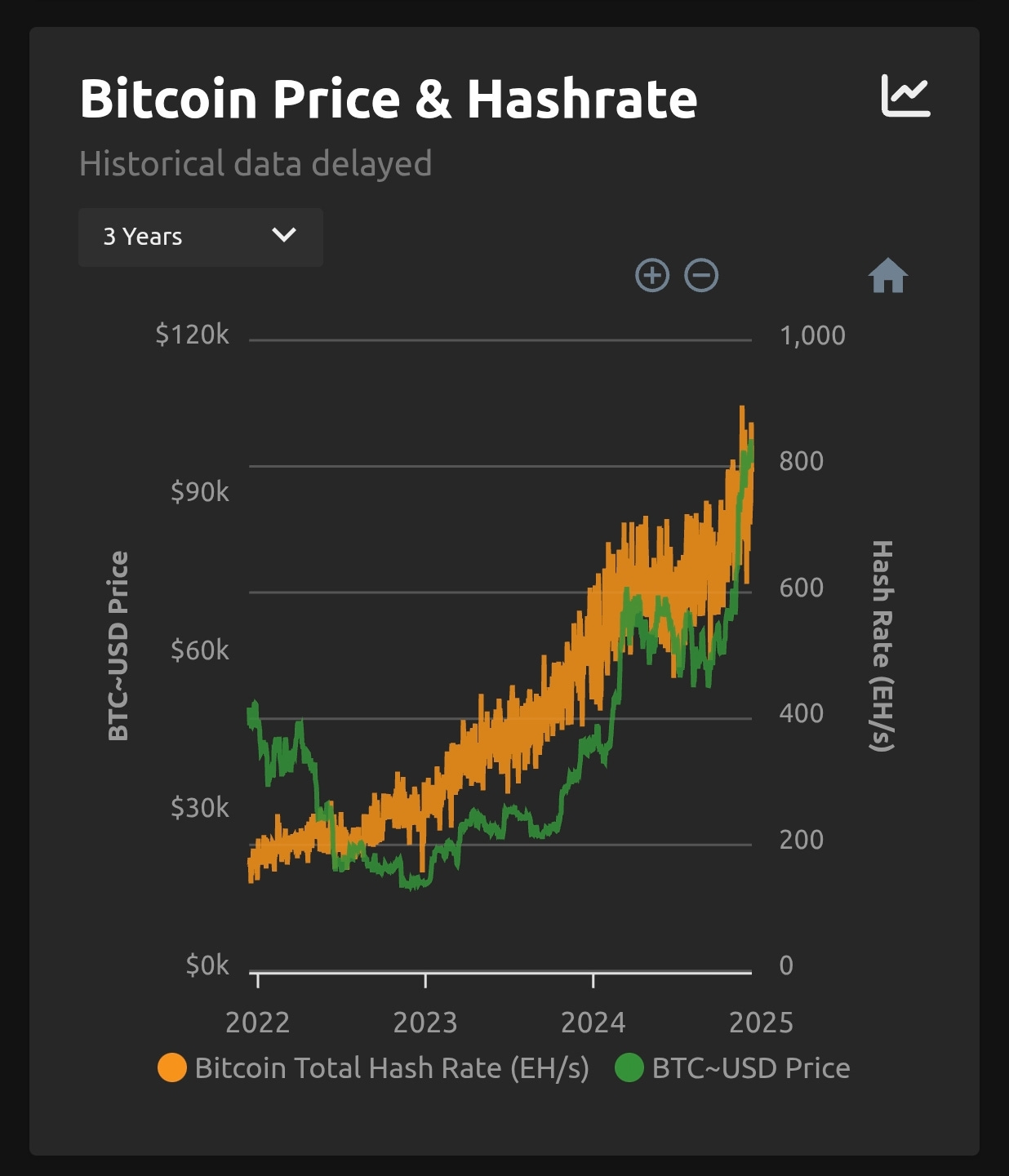

The Bitcoin Price vs Hashrate chart shows the relationship between Bitcoin's price and the network's mining power (hashrate).

Price Predictive Trends:

Rising hashrate often follows price increases, reflecting miner optimism and higher network security.

A falling hashrate can indicate miners exiting due to low profitability, possibly signaling further price declines.

Lagging Correlation:

Hashrate lags behind price changes; a rising price predicts future hashrate growth, while a price drop may lead to delayed hashrate reductions.

Sentiment Indicator:

Stable or rising hashrate during price dips suggests long-term miner confidence, hinting at potential recovery.

You can use the Bitcoin hashrate v price chart to gauge miner sentiment and anticipate price movements based on network security trends.

This is a great way to DCA w/o doing any TA or speculation. What BitcoinHash rate sites would you recommend? One that overlays the price of BTC with the Hashrate of BTC?